Every January, the ISR 1099 form shows a rapid increasing in Google search volume. People are looking for practical tips and tricks to fill out 1099 forms. If you need to fill the form in this year, or simply want to find out what is an ISR 1099 form, look no further than this blog! We've gathered all information about the 1099 forms and provide you with a step-by-step guide to help fill out 1099 forms correctly. Make sure to read this article to avoid making any mistakes before filing a 1099 form to the IRS.

What Is an IRS 1099 Form?

The IRS 1099 form is a collection forms that designed for people to check their incomes or payments that aren’t given by employers. In other words, all your incomes that don’t belongs to the routine salary should be recorded on a 1099 form, including rents, royalties, gambling winning, dividend, interest payments, etc. The payer fills out IRS 1099 forms with all details and then send these forms to you and the IRS, aimed to report payments details in a tax year. According to the regulations, most 1099 forms must be provided by January 31 of every year, and in case of unexpected situations, the date can be delayed to February 15.

Different Types of Form 1099

There are ten more types of IRS 1099 forms, and each of them is used for different purposes. In this part, we’ll mainly introduce two most common 1099 forms: 1099-NEC and 1099-MISC.

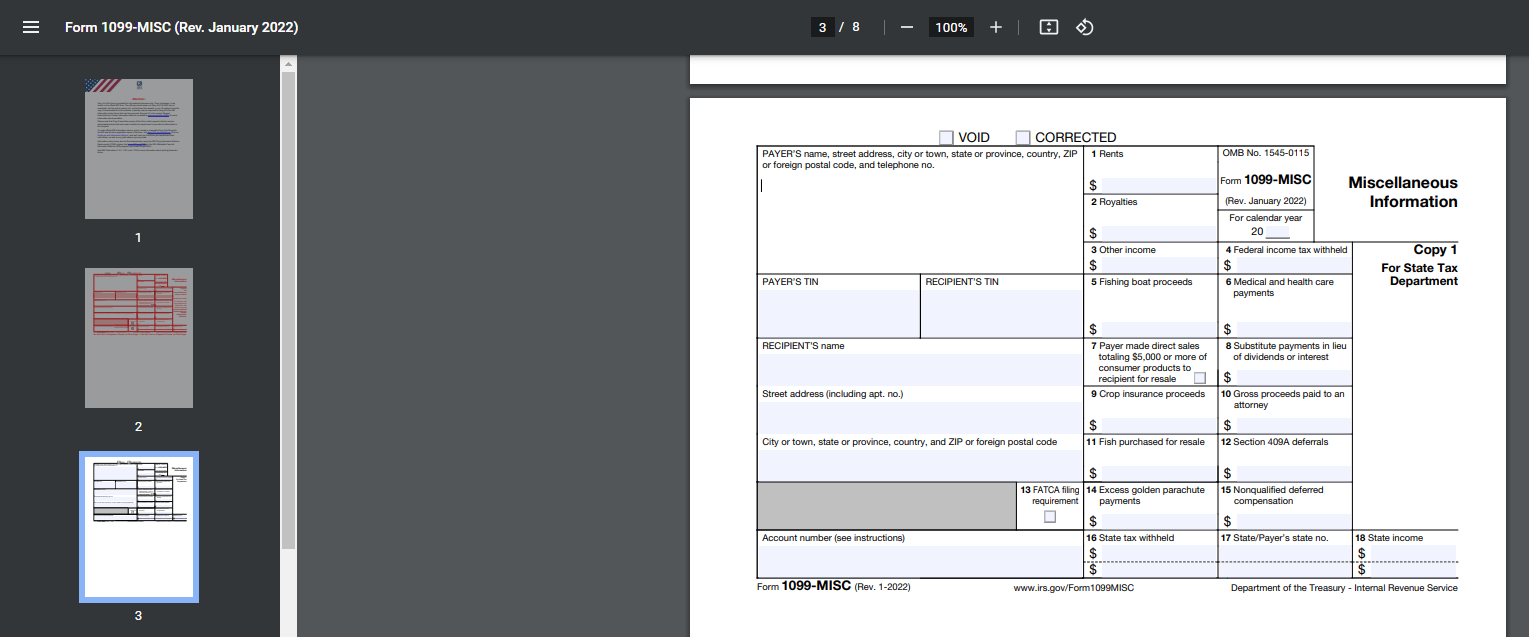

Form 1099-MISC: Miscellaneous Information

For each person in a year whom you have paid for at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest, and at least $600 in rents, prizes and awards, other income payments, cash paid from a notional principal contract to an individual, partnership, or estate, any fishing boat proceeds, medical and health care payment, crop insurance proceeds, gross proceeds paid to an attorney, section 409A deferrals, or nonqualified deferred compensation.

Form 1099-NEC: Nonemployee Compensation

For each person in a year received at least $600 in service performed by someone who is not your employee (including parts and materials) or payments to an attorney, including services performed by someone who is not your employee or payments to an attorney.

You May Also Like: All about W-9 Form: What It Is, What It Is Used for, and How to Fill It Out >>

What Is a 1099 Form Used For?

A 1099 form is used to finger out how much income you’ve received in a year (these payments aren’t come from your employer) and what kind of income it was.

Usually, you won’t receive any 1099 form from the employer, but if so, that means the employer treats you as an independent contractor rather than an employee. People who work as a freelancer are more likely to get a 1099 form.

Is a 1099 Form necessary to File the Taxes?

Let’s come with the answer directly: to file your tax, the 1099 form isn’t a must. When filing taxes, you only need to report all your incomes and, in a year, even if you didn’t get your 1099 form, and you don’t have to send the 1099 form to the IRS since the payer will.

Do I Need to Pay Taxes on a 1099 Form?

Receiving a 1099 form does not automatically imply that you owe taxes; however, it does indicate that the income reported on the form is not subject to traditional withholding, as is the case with a W-2 form. Most of the time, you will be required to report and pay taxes on the income reported on your 1099 form. The specific tax requirements will be determined by a number of factors, including your overall income, deductions, and applicable tax laws. To ensure accurate reporting and compliance with IRS regulations, it is critical to understand your tax situation and consult with a tax professional or use tax software.

Fill Out the IRS 1099 Form (1099-MISC)

To fill out an IRS 1099 form, the first and foremost step you need to do is to get the form template from the IRS official website. A 1099 form contains five copies of one form, including copy A appears in red which is designed for the IRS, copy B and other copies all appear in black and copy 1 is for the state tax department (if needed), copy B and copy 2 are kept by the recipient, copy C is for your own records. In addition, copy A cannot be printed or downloaded offline while other copies don’t have such restrictions.

Here’s how to fill out a 1099-MISC form:

Step 1. Obtain the correct 1099 form

Determine which 1099 form you require based on the type of income you are reporting. For example, if you're reporting income from freelance work, you'll need a 1099-MISC form.

Step 2. Gather necessary information

Collect all the required information for both yourself (the payer) and the recipient of the payment (the payee). Names, addresses, and taxpayer identification numbers (TINs) or Social Security numbers (SSNs) are all included.

Step 3. Enter the payer's information

In the Payer's Information section of the form, enter your name, address, and TIN or SSN.

Step 4. Fill out recipient information

In the Recipient's Information section, enter the payee's name, address, and TIN or SSN. If the payee is a business entity, you may need to use their Employer Identification Number (EIN).

Step 5. Provide payment details

Report the payment amount made to the recipient during the tax year in the appropriate boxes.

Step 6. Report federal income tax withheld (if applicable)

If you withheld federal income tax from the recipient's payment, enter the amount withheld in Box 4. This is common for certain types of income, such as backup withholding.

Step 7. Fill out state tax withholding (if applicable)

If you withheld state income tax from the payment, enter the withheld amount in the state tax withholding box, if provided.

Step 8. Fill out any additional information that is requested

Depending on the specific 1099 form you're using, there may be additional boxes or sections that require information related to the type of income being reported. Fill out these sections as necessary.

Step 9. Review and validate the form

Examine all of the information you've entered to ensure its accuracy. When it comes to filing taxes, mistakes or missing information can cause problems for both you and the recipient.

Step 10. Distribute copies

Make copies of the completed 1099 form for your records, as well as for the recipient. Provide the recipient with their copy by the deadline specified by the IRS (generally by January 31st).

Step 11. File the form with the IRS

Depending on the volume of forms you're filing, you may need to file them electronically or mail paper copies to the IRS. Check the IRS instructions for the specific filing requirements and deadlines.

Remember to stay up to date on the most recent IRS guidelines and instructions for filling out and submitting 1099 forms, as they may change over time. If you have any questions about the process, consult with a tax professional or use tax software to ensure accurate and timely filing.

Bonus Part: A Safe PDF Form Printer

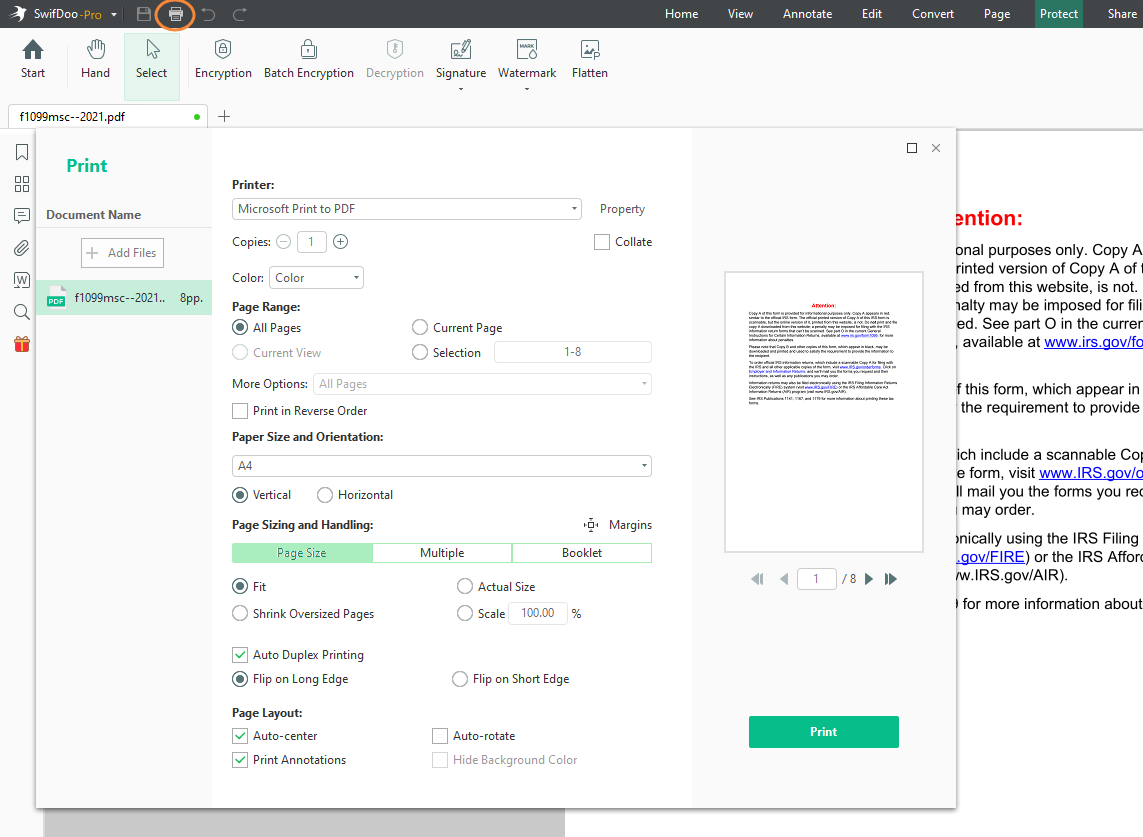

Sometimes you may need to print 1099 forms and file the paper copies to the IRS, a dedicated PDF printer is highly needed. Luckily, there’s a popular PDF tool that can help print PDF forms with all-around features that is named SwifDoo PDF.

SwifDoo PDF is a Windows-based PDF editor with comprehensive features to help you edit, convert, compress, protect, and print PDF files hassle-free. When requiring printing 1099 forms in color, print them with multiple copies in one shot, or print all forms in one sheet, SwifDoo PDF makes the process simple and easy to follow. Let’s see the specific steps:

Step 1. Free download and install SwifDoo PDF on your PC.

Step 2. Open your 1099 form in this program. Then click on the print icon (or press Ctrl + P).

Step 3. Select a proper printer and adjust related settings in the print pop-up window.

Step 4. Tap the Print button.

10 Best PDF Translators That You Must Know in 2025

Check this post to find out the 10 best PDF translators in 2025. We've tested and selected them from different aspects to help you translate your PDF documents.

READ MORE >The Bottom Line

After reading this post, you’ll have a comprehensive knowledge about the IRS 1099 form. In this article, we’ve thoroughly explained what 1099 forms are, what are they used for, how to fill out a 1099 form, and many other helpful information of this form. In addition, a handy PDF printer called SwifDoo PDF is also introduced for you to easily print 1099 forms. Don't forget to download it and give it a try!