A W-9 or W9 form is a tax form furnished by Internal Revenue Service (IRS). It is one of the most common tax documents used by contractors to provide tax identification information. Do you need to handle a W9 form 2022 but have little knowledge about it? Take it easy. This post is here to help.

From what a W-9 form is and what it’s used for to how to download and fill it out, you will find a clear and practical introduction. If you store and submit a W-9 electronically, it’s necessary to sign and date the form with a PDF editor like SwifDoo PDF.

What Is a W9 Form?

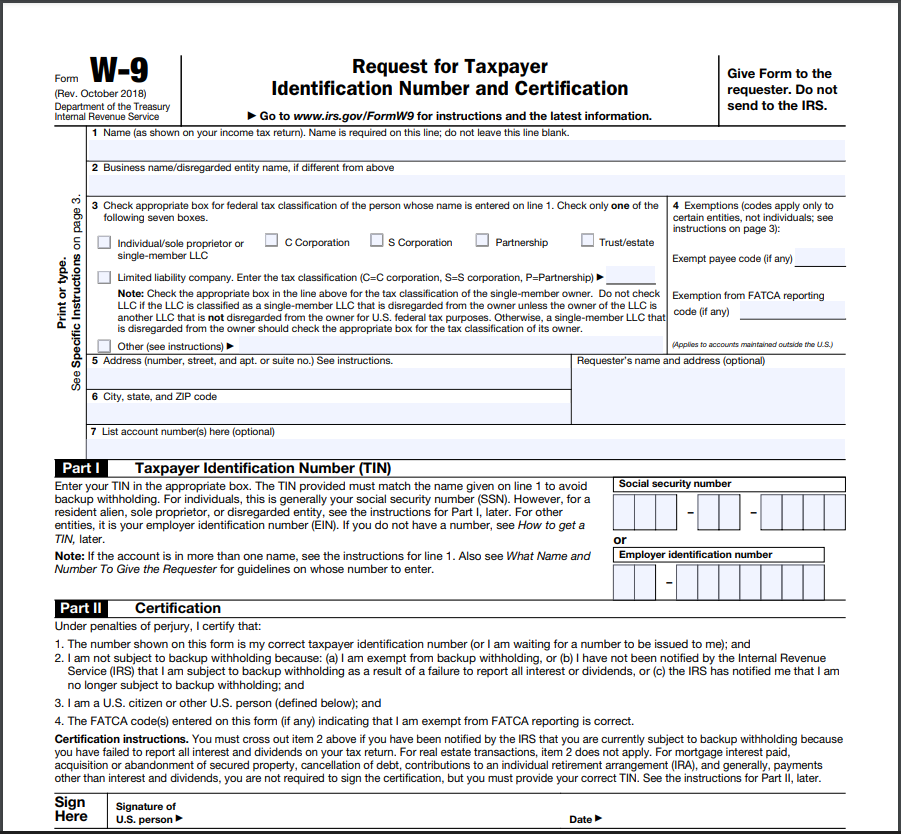

A W-9 form is officially called Request for Taxpayer Identification Number and Certification. It’s usually asked by employers to request information from individuals or businesses they hire, not the employee. The employer needs the form to issue the hired person a Form 1099-MISC and file the 1099 with IRS. So the IRS can know how much income the payee (hired person) earns and determine his tax debt.

The IRS W-9 form is filled out by the hired party or payee, then received and kept by the employer or payer. It will not be sent to the IRS.

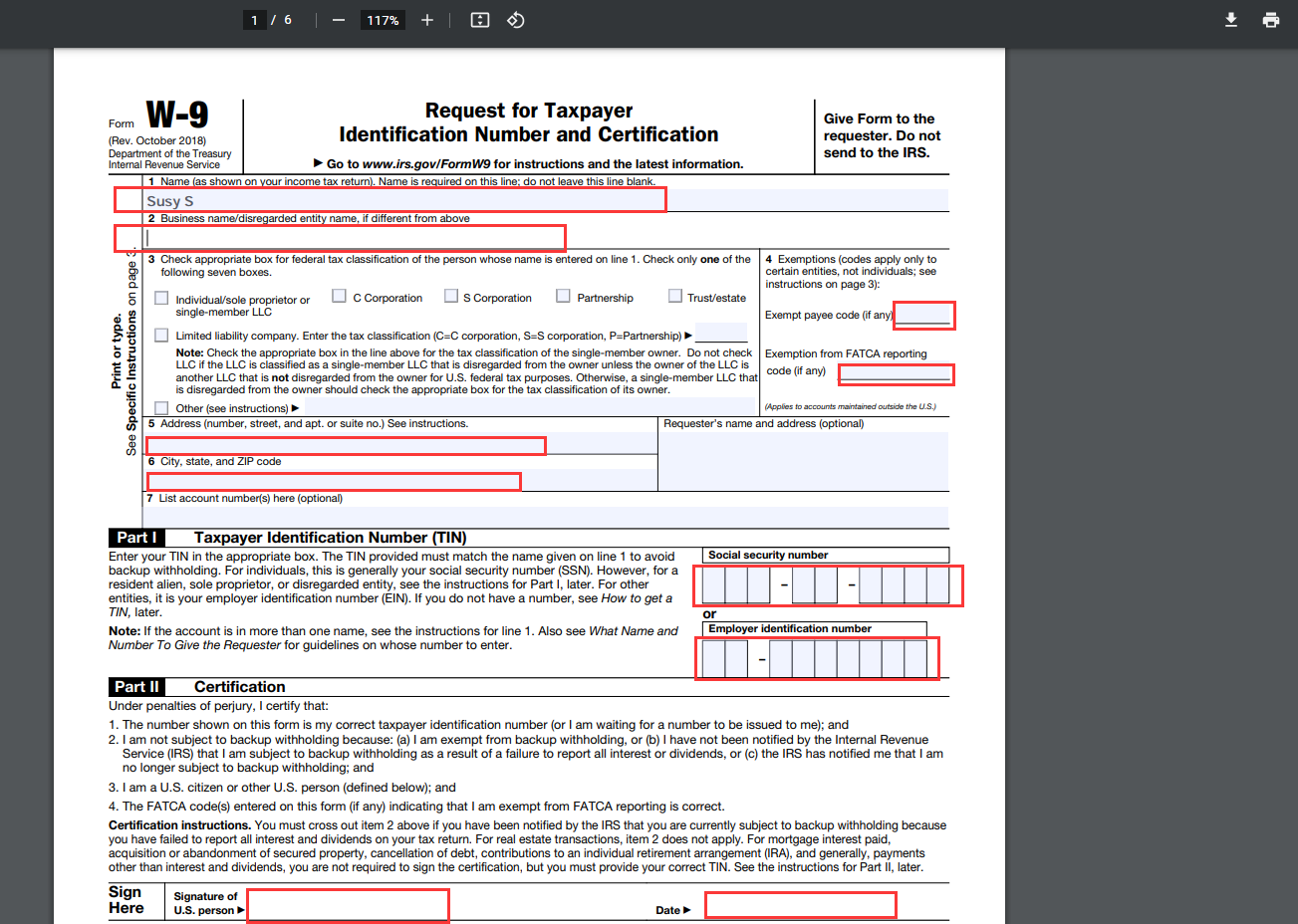

Main information required on a W-9 form 2018-2023

- The payee’s name

- Business name

- Federal Tax Classification: Individual/sole proprietor or single-member LLC, C Corporation, etc.

- Mailing address

- The payee’s taxpayer identification number (TIN): Social Security number (SSN), or Individual Taxpayer Identification Number (ITIN)

- Exempt payee code: Indicate that the payee is exempt from withholding tax

- Signature and certification

Check the picture below to get what a blank fillable W-9 form looks like. After the fillable form part, there are 5 pages of instructions for correctly filling out your W9 form 2022 or 2023.

What Is a W-9 Form Used for?

The purpose of W-9 is to provide or collect identifiable tax information from an individual or a company for specific use. The requesters may use the information on the form to file returns (such as 1099 Forms) reporting to the IRS. Here are 4 use cases of the W9 form.

Income report to IRS: When a company pays a contractor more than $600 in a tax year, the company will request the contractor to submit a completed W-9 form. This is because the company need the tax information on the form to file Form 1099 for reporting the income paid to you to IRS.

Backup withholding prevention: The W-9 tax form can also be used to avoid backup withholding for the payee. Payers may be required to collect withholding taxes for the IRS receiving income taxes sometimes. If your business is exempt from backup withholding, providing the exemption information on the form will prevent the payer from withholding taxes.

Financial account information request: Financial institutions may also use IRS W-9 forms to ask their customer to provide information.

Debt or loan cancellation: Another purpose of a W-9 is to complete the process of canceling debt, student loans, or other transactions. If your debt is forgiven, you will need to make a Form W-9 ready for sending to the creditor. So the creditor will file Form 1099-C and cancel the debt.

Latoria Williams, the CEO of 1F Cash Advance, says, "This form includes details such as the debtor's information, the amount of canceled debt, the date of cancellation, and the reason for cancellation. The creditor also needs to select the applicable box indicating the identifiable event that led to the debt cancellation."

Therefore, when the payer's payment to the non-employee payee is less than $600 during a tax year, or the payment is not related to a business or trade, a W-9 is not required.

Who requests a completed W-9 form

From the above use cases, it’s easy to find that the person or business who pay you and need to file reports to IRS will ask for a filled W9 form. Banks or financial institutions may also require the tax form from their clients. The requester won’t file the form but keep it.

Who is required to fill out a W-9 form

People who are responsible for filling out a W-9 form are usually self-employed, including independent contractors, freelancers, gig workers, and consultants. If your employer sends you an IRS W-9 to finish, it has likely classified you as one of the mentioned roles. According to your business structure, you need to choose the federal tax classification as Sole, Limited Liability Companies (LLCs), C-Corporations, or another item on the form.

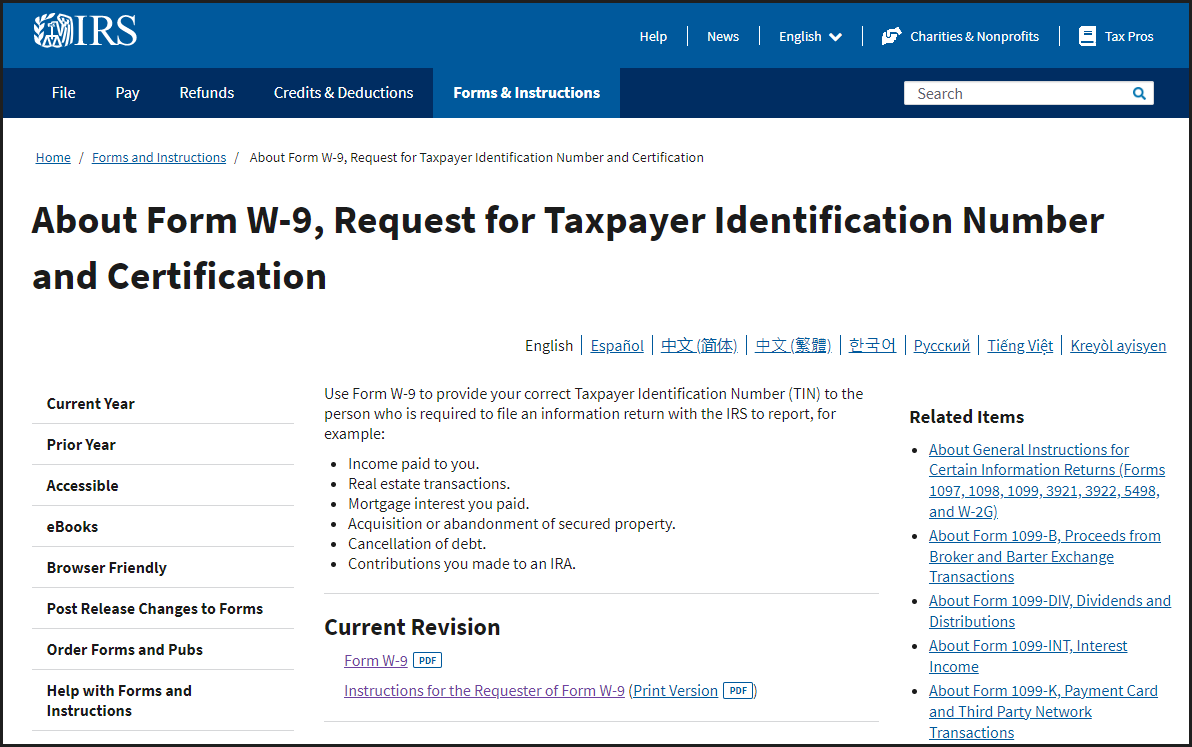

Download the Free W-9 Form 2022 or 2023

When you need to prepare and submit a W-9 form 2022 or 2023 to your employer, go to the IRS website to get it. From that place, you can download the W-9 form for free and read relevant instructions. In fact, the W-9 form 2018-2022 uses the same PDF document and it’s fillable. The same to form 2023. Oftentimes you may get the form from the requester without downloading by yourself.

How to Fill Out a W-9 Form

You can complete Form W-9 on paper or electronically. To do the work on paper, print the blank form and write the necessary information by hand. Then scan the form to a PDF for sending or archiving. To fill out your W-9 form 2022 or 2023 electronically, follow the steps below.

Step 1: Right-click on the downloaded W9 form and choose Open with to open it in Chrome or some other browser;

Step 2: Click the blank field on Line 1 to enter your name as shown on your tax return;

Step 3: Type your business name on Line 2 if you do business using a business name;

Step 4: Click and check an appropriate box on Line 3 to select your federal tax classification;

Step 5: Give your exempt payee code if there is, to state you are not subject to withholding tax;

Step 6: Fill in your mailing address including street address, city, and zip code on Line 5 and 6;

Step 7: Provide the form requester’s information or not;

Step 8: Type your Taxpayer Identification Number (TIN);

Step 9: Save the correctly filled W9 form 2022 or 2023, print it out, sign and date the form under Part II, then send it to the requester.

Note: If you don’t have a TIN (SSN or EIN), enter “Applied for” in the SSN or TIN boxes. There will be 60 days for you to provide the TIN. You can apply for a TIN from the IRS site. It’s better to double check that all the information filled in is correct. You will receive your 1099-MISC form later at the mailing address.

The Best PDF Editor to Add Signature and Date to Your W-9 Form

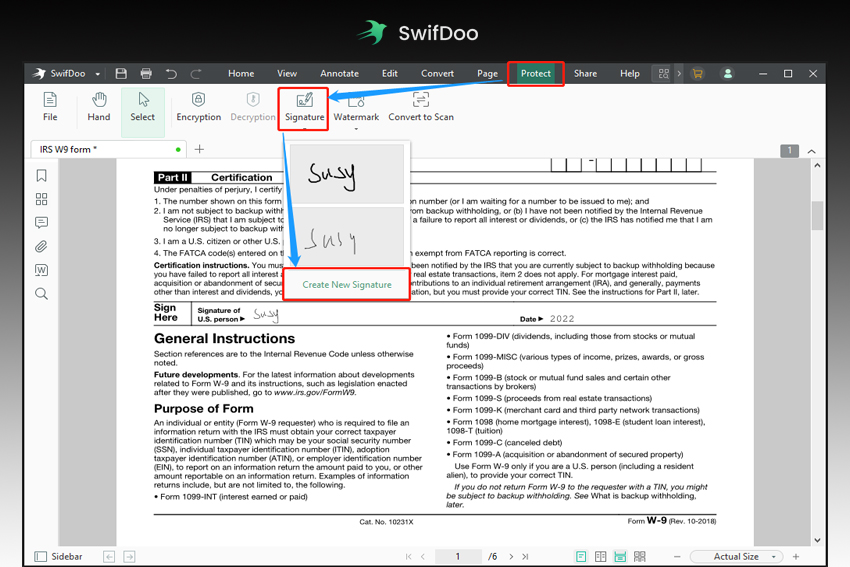

If you wish to sign and date your IRS W-9 form 2022 directly without printing it out, use the PDF editor, SwifDoo PDF. The handy application allows you to add text boxes to a W-9 form PDF and type text without a hassle. All you need to do is open the form in the PDF software and choose “Annotate” > “Typewriter”. Then click the specific space to enter the date.

SwifDoo PDF also makes adding text or image e-signatures to a PDF effortless. Take a look at the brief guide.

Step 1: Drag and drop your W9 form 2022 into the PDF editor, go to Protect to choose Signature and click Create New Signature;

Step 2: Choose to upload an image signature or create a handwritten signature, and click OK;

Step 3: Put your signature to the proper location and resize it.

When needed, you can use SwifDoo PDF to password protect the W-9 form PDF from unwanted access or editing. So only the requester can open and view your information. The software has many more tools to deal with PDFs. If you work with PDF documents frequently, having SwifDoo PDF will make you productive.

More Knowledge about W9

If you are confused about what W9 forms differ from other forms, here are some information to help.

W-9 vs 1099

The difference between W-9 and 1099 is that the W-9 form is filled out by payee while the 1099 is completed and filed by the payer. Payers collects W9 forms to gather information from payees so as to write the information onto 1099 forms. Payers use the 1099 form to report the income paid to the payee.

W-9 vs W-2

A W-9 form is filed by an external worker such as a contractor to provide information for the employer. Employers are responsible for offering employees an IRS Form W-2 and they’re free to generate W2 forms from third-party websites if they’re accurate. When you work for a business as a non-employee, you are likely to give them your done W9 tax form.

W-9 vs W-4

Contractors or other self-employed workers fulfill the W-9 form to provide their taxpayer Identification Number (TIN) and other tax information. W-4 form is completed by employees of a company to tell their company how much federal income tax to withhold from their wages.

Conclusion

This post has a comprehensive introduction to the W-9 form, so you will be aware what it is, what it is used for, and how to fill it out. To fill out the form, you don’t need third-party software and can do that within your browser. For signing and adding a date to your W9 form 2022 and 2023, you can make use of SwifDoo PDF editor.

Frequently Asked Questions

Is W9 form mandatory?

If you are independent contractors or other self-employed workers and are paid more than $600 in a calendar year, you are required to file the W-9 form.

What happens if I don't fill out a W9 form?

If you are required to send an IRS W-9 form but refuse it, you may be subject to a $50 penalty from the IRS. Your client or your employer can withhold taxes at a rate of 24% and up to 28% on your payments.

What happens if you fill out a W9 form incorrectly?

If you fill out a W-9 form with incorrect information such as the wrong taxpayer identification number, you will face penalties.

Do I have to report my W9 form to the IRS?

You will never need to send the W-9 form to the IRS and should send it to the requester. The IRS doesn’t need it and only the requester does.

Will filling out a W-9 affect my taxes?

Perhaps you are wondering whether you have to pay taxes if filling out a W-9. Actually, the tax form is used by your employer or the payer to issue you a Form 1099-MISC. So the IRS can know how much taxes you will pay. Filling out a W-9 form means you will need to pay taxes but the IRS and your employer usually won't withhold taxes from your earnings.