Our salaries often get credited, but they last only a week due to improper planning of our finances. Now you can control it by strategically planning your expenditures to help save money and maintain your finances.

If you, too, are stressed over the drooping balance in your accounts but fail to maintain a track record of the same, you need a budget. You can now resort to making a budget for daily life.

With the help of a budget template, you can manage your expenses and savings in the given income to last you throughout the month. Budgets help you shape your finances to motivate you to achieve larger life goals.

After all, the right step to financial planning begins with making a budget and following one. Though at first, it might not be easy. But regular practice can surely guide you to attain successful financial independence.

What Is a Budget?

A budget helps you track your money and control it. It is the best medium to achieve your financial goals by efficiently planning your income and expenses. It sets a benchmark of your income to allocate efficiently to your various expenses over a defined period. Hence, it is a financial plan for a set duration.

A personal budget helps you maintain your daily life finances and differs for each individual. Usually, apart from the personal factors, the economy also plays a particular role in defining and maintaining our budget as a few factors like expansion, contraction, inflation, etc., affect our finances.

Many factors might affect your budget. Such as :

- Age

- Responsibilities

- Size and income of the family

- Family’s socio-economic status

- Financial potential

- Spending behavior

- Emergency provisions

- Culture

- Economy

- Financial goals

- Savings and investments

Still, Taking the Load of Financial Planning?

Financial planning is not a game of a day. Instead, it is a never-ending process. Despite it having no ends, you surely know where to start. Yes, by maintaining a budget. There are multiple reasons for using a budget. Some of them are listed below:

- Gain control over finances

- Achieve goals

- Keeps you honest

- Improve financial habits

- Avoid debt

- Improve credit

Relieve Your Mental Stress with a Planned Budget

Though a budget may sound synonymous with arranging your finances, there is much more to it. A well-planned budget helps you with multiple benefits to avoid overspending on unnecessary things, control your finances and, in turn, enjoy a calculated and smartly financed future.

- Improves financial literacy

- Tracks financial goals

- Leads to a happy retirement life

- Adequate funds to manage contingencies

- Discourages spendthriftness

- Controls debts

- Improves debt repayment strategy

- Prevents money mistakes

- Decreases future financial stress

- Makes aware of savings and debts

- It helps you set priorities

- Manage investment decisions

- Helps manage unexpected costs

- Helps manage borrowings

- Aids in financial decisions

Allocating Your Sources of Incomes Wisely

Your income is generally divided into three possible zones. The main categories of a personal budget include:

- Needs

- Wants

- Savings/ debt payoffs

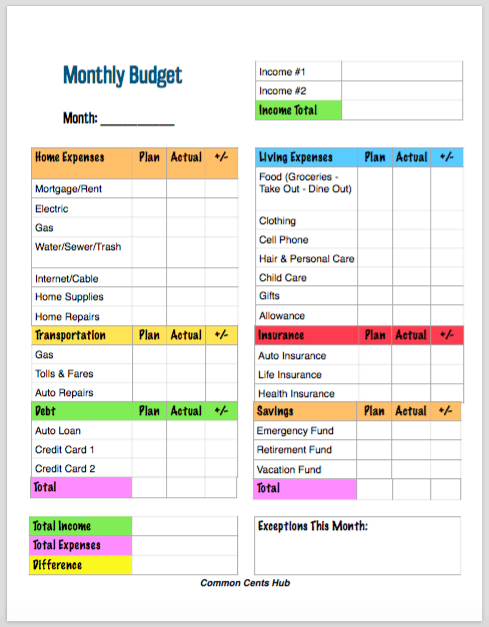

Monthly Budget Template: Channelising Your Funds in the Right Track

Now prepare a monthly budget template to track and maintain your finances to help you stay motivated and achieve your financial goals.

The websites where you can free download printable monthly budget templates include Common Cents Hub, Smartsheet, etc. Such a budget generally categorizes the basic expenses and savings in various subdivisions that include:

- Housing

- Utilities

- Transportation

- Debt

- Food

- Clothing

- Child care

- Medical/ healthcare

- Insurance

- Household items/ supplies

- Personal/ entertainment

- Gifts/ donations

- Emergency funds

- Retirement funds

- Vacation funds

These are only broader subdivisions you can further classify to go into deep detail.

Quick Ways to Manage Your Expenses

While managing expenses might not have felt more effortless, you can certainly be in charge now. With a few tips for managing your daily life spending, you can keep going:

- Account your income sources:

Before spending, you must be fully aware of all your sources of income. It might be from a job, rent, interest, or dividend. Once you are aware of your funds, only then can you plan for the month accordingly.

- Track your spending habits:

It would be best to control the power of money before it starts holding you. Cutting unnecessary expenses is only possible when you track your spending habits. Always prioritize your needs over wants. Remember, discipline begins with self.

- Prioritize the necessary:

Expenses have no end, but the funds are limited. You cannot spend on anything and everything without thinking about it twice. It would help if you always prioritized the essentials over other things. Once you are done with the necessary spending, you can think of a buffer to spend on your desirable options.

- Prepare 2 budgets for the month:

Generally, we run out of funds by mid-month, which means that now you can’t spend as lavishly as in the prior two weeks. So you can prepare two budgets for the month, the first for all the utilities, needs, and debt payoffs, while the second will ensure you save for contingencies and cater only to the healthy wants.

- Share responsibilities:

Depending upon the number of bread earners and their incomes, you can share your responsibilities to spend wisely. If you are a middle-aged earning couple, the salary of one can be used to pay off the bills and other necessary expenses while the other person can keep his funds entirely for savings and investment. Or you people can share your load by chalking out who will be paying for what beforehand.

- Keeping funds to meet utilities:

As soon as the month starts, the essential list of expenses hits your pockets: electricity, water, rent, and other unavoidable costs. The first thing you should do with your income is to keep the overestimated expenses to pay off these utility expenses. As these are a part of your fixed expenses, you cannot cut these short unless there is an exception.

- Child care funds:

Being an adult isn’t easy, especially when you have a household to run all alone and a child/ children to manage. For instance, you can cut your expenses but wouldn’t like to compromise your child’s happiness. Ensure to keep a basic amount for your child’s care depending upon his age and needs. It might include his books, snacks, parties, pocket money, etc. No amount can be significant enough, but an estimate is necessary to spend healthily.

- Manage groceries and other household expenses:

Once you have paid all your debts and cleared your dues for the month, plan on the grocery and essential household items. When visiting a mall, prepare a purchase list and commit to not buying anything beyond the stated ones. Start with the bare kitchen essentials that are most necessary for survival. Then based on your priorities, you can prefer to spend on other essential stuff.

- Transportation and commute:

If you are a working professional, you cannot ignore how transportation and commute consume a large chunk of your income and overlook such expenses. Keep a sum above the defined amount, always ready to never run out on your transportation cost.

- Plan staycations:

Instead of traveling, engage in staycations as it is way cheaper. Book the place for a month instead of a few days with your friends to divide your expenses. Get your own kitchen and cut down on your food bills as well.

- Gifts, parties, and charity/ donations:

You should earn not only to pay your bills but also to entertain yourself. But then, even entertainment has a cost. To make sure you can afford one, save enough to plan for your entertainment needs. It would help if you always kept a set percentage of your income for gifts and get-togethers and could also engage in some charity and donations.

- Medical and insurance:

You can never afford to compromise on medical bills and insurance. Whether your health or your loved ones, you always need to save enough to meet their medical expenses. Though at times, less is more, in case of medical expenses, keep as many funds secured as possible to avoid any future mishap.

- Contingencies and investments:

Even after thorough planning, few events are such that are not under anyone’s control and are usually unavoidable. Like the arrival of a guest, vehicle breakdown, litigation, a gathering, etc., you must always be prepared for such cases and save a portion of your funds to meet such uncalled expenses.

Apart from the expenses, your savings also account for investments. Make sure to save enough to achieve your financial goals.

You may also like:

3 Tips for Designing a Blank Monthly Calendar PDF Template

Making a calendar with your favorite photos can give you great pleasure. Check how to download and design a blank monthly calendar template PDF.

READ MORE >How to Plan Your Monthly Budget: A Quick Guide, Tips and Tricks

You can plan your monthly income by allocating the right amount in your expenditure and savings. For this, you need a budget planner to plan your expenses strategically according to your needs and wants.

Some general budget rules that you can follow are:

- Be informed of all sources of income

- Set your finance goals

- Consider long-term needs

- Prefer making and tracking a budget

- Break down the budget

- Always overestimate your expenses

- Prefer the cash system over cards to avoid overspending

- Prioritize needs over wants

- Set your savings aside before spending

- Practice the budgeting skills

How to Create a Personal Budget: Step In and Level Up Your Finance Game

Now create your budget, keeping in mind some valuable points and information. Following the below-given steps, you can easily create your monthly personal budget:

- Make financial goals

- Collect your financial statements

- List out all sources of income

- Chalk out all the expenses

- Define fixed expenses

- Segregate variable expenses

- Sum up your monthly earnings and total expenses

- Make a place for savings

- Review your budget monthly

- Adjust your goals whenever necessary

Budget Template PDF

To make a proper budget plan, a good choice will be to opt for a budget template. Such a template helps you keep track of your spending habits, improving your financial health in return. Once you categorically know your expenses, it becomes easy to track them down.

You can easily download, print, and maintain a daily life budget with the help of a template to manage your budget. Usually, such templates are in PDF format.

You can download your template from various websites such as:

- Consumer

- Navy federal

- On planners

- Savvy budget boss

- 101 planners

- A to Zen life

- Vacu

- Template

- Printables and inspirations

- Shining mom

- Cute freebies

- Leap off aith crafting

To open and read your budget template PDF, you can use a PDF reader, say, SwifDoo PDF software. With SwifDoo PDF, you can also edit your template to customize it as per your needs.

A Quick Wrap Up

If you are new to managing household finances or facing difficulties managing one, control your daily cost with proper planning and a budget. We have provided you with many options to maintain a budget. But you are the best person to help yourself as everyone has a different lifestyle. Choose the one that makes the most logical sense to you.

You can either opt for one or choose a combination of multiple budgets to plan your finances sensibly. You can also use a monthly budget template to track your savings.

If one budget system does not work for you, you can try another or customize it to your needs to make it more effective. The budgeting process should always be easy to follow in the long run.

Start your financial planning today with the help of a budget planner—cheers to a step towards financial independence.